Level 1:

Stocks went down a lot on Friday. This made Wall Street worried about what might happen next because interest rates are going up. The S&P 500 had its worst week since September. The Dow Jones Industrial Average went down by 345 points. The Nasdaq composite also went down. This was the second day in a row that banking stocks went down a lot. There was a bank that went bankrupt, and this made people scared that other banks could have problems too. This could be very bad.

Level 2:

Stocks on Wall Street went down last week due to concerns about increasing interest rates and bank failures. The S&P 500 dropped 1.4%, marking its worst week since September. Despite reports of slowing pay raises for workers and cooling pressure on inflation, the Dow Jones Industrial Average fell 1.1%, while the Nasdaq composite tumbled 1.8%. The financial industry experienced some of the sharpest drops for a second day. The sudden midday takeover of Silicon Valley Bank by regulators and the voluntary shutdown of Silvergate Capital also added to concerns of a potential banking crisis. When investing in stocks, it is important to be careful because the stock market can be unpredictable.

Full Story:

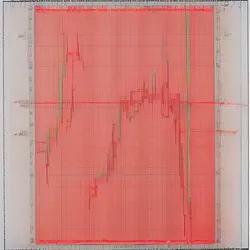

Stocks tumbled on Wall Street on Friday as investors reacted to news of the biggest U.S. bank failure in nearly 15 years, and concerns about rising interest rates. The S&P 500 fell 1.4%, marking its worst week since September. The Dow Jones Industrial Average dropped 345 points, or 1.1%, while the Nasdaq composite sank 1.8%.

Some of the sharpest drops came from the financial industry, with banking stocks hit particularly hard. Regulators took over Silicon Valley Bank in a surprise midday move after shares of its parent company, SVB Financial, plummeted more than 60% this week. The company, which served the startup industry, was trying to raise cash to relieve a crunch. Analysts have said it was in a relatively unique situation, but it has led to concerns a broader banking crisis could erupt.

The market’s response came amid what strategists in a BofA Global Research report called “the crashy vibes of March.” Markets have been nervous about high inflation, which could force the Federal Reserve to reaccelerate its hikes to interest rates.

The yield on the 10-year Treasury fell sharply from 3.91% to 3.69%, helping to set rates for mortgages and other important loans. Some of the sharpest drops on Wall Street came from banking stocks, with worries about who else may suffer a cash crunch if interest rates stay higher for longer and customers pull out deposits. This could force banks to sell bonds to raise cash, right as higher interest rates knock down prices for those bonds.

Besides SVB Financial’s struggles, Silvergate Capital said this week it’s voluntarily shutting down its bank. It served the crypto industry and had warned it could end up “less than well-capitalized.” Stock losses were heaviest at regional banks. First Republic Bank tumbled 14.8%, but filed a statement with regulators to reiterate its “strong capital and liquidity positions.” Charles Schwab lost another 11.7% after dropping 12.8% on Thursday, “as investors stretched for read-throughs” from the SVB crisis, according to analysts at UBS. The analysts called them “logical but superficial” because of differences in how companies get their deposits.

Larger banks, which have been stress-tested by regulators following the 2008 financial crisis, held up better. JPMorgan Chase rose 2.5%. All told, the S&P 500 fell 56.73 points to 3,861.59. The Dow lost 345.22 to 31,909.64, and the Nasdaq dropped 199.47 to 11,138.89.

Investors are closely watching the situation to see how it develops in the coming weeks. Some experts believe that the market is simply going through a correction, with stocks having been overvalued for some time. Others worry that the problems in the financial industry could lead to a broader economic downturn.

It’s important to remember that the stock market is inherently unpredictable and subject to fluctuations based on a wide range of factors. While Friday’s tumble was significant, it’s important not to overreact or make hasty decisions based on short-term market movements. Instead, investors should take a long-term approach to investing and focus on building a diversified portfolio that can weather market volatility.

In conclusion, the recent stock market tumble on Wall Street has been driven by concerns about rising interest rates and the fallout from the biggest U.S. bank failure in nearly 15 years. While the market’s response has been significant, it’s important to remain calm and focused on long-term investment strategies. As always, investing carries risk, and it’s important to consult with a financial advisor before making any major investment decisions.

Questions:

What factors caused the stock market to tumble on Wall Street?

Why did the financial industry experience some of the sharpest drops?

How did the regulators take over Silicon Valley Bank?

Why is it important to be careful when investing in stocks?

In your opinion, do you think the concerns about rising interest rates and bank failures are justified?

Fill In the Blanks:

crunch, tumble, deposits, midday, reaccelerate, Regulators, regulators

________ took over Silicon Valley Bank in a surprise ________ move after shares of its parent company, SVB Financial, plummeted more than 60% this week.

The company, which served the startup industry, was trying to raise cash to relieve a ________.

The market’s response came amid what strategists in a BofA Global Research report called “the crashy vibes of March.” Markets have been nervous about high inflation, which could force the Federal Reserve to ________ its hikes to interest rates.

Some of the sharpest drops on Wall Street came from banking stocks, with worries about who else may suffer a cash crunch if interest rates stay higher for longer and customers pull out ________.

First Republic Bank tumbled 14.8%, but filed a statement with ________ to reiterate its “strong capital and liquidity positions.” Charles Schwab lost another 11.7% after dropping 12.8% on Thursday, “as investors stretched for read-throughs” from the SVB crisis, according to analysts at UBS.

While Friday’s ________ was significant, it’s important not to overreact or make hasty decisions based on short-term market movements.

Vocabulary:

Tumble: to fall or decline suddenly and steeply,

Regulators: organizations responsible for supervising and controlling specific areas of business activity,

Midday: the middle of the day,

Shutdown: the act of closing down or ceasing operation,

Crunch: a critical situation that requires decisive action or intervention,

Subdue: to overcome or bring under control,

Reaccelerate: to speed up again after a slowdown,

Mortgage: a legal agreement in which a person borrows money to buy property, and the lender holds the property as collateral until the loan is repaid,

Bond: a certificate issued by a government or company promising to pay back a loan with interest,

Deposits: money placed in a bank account or other financial institution,

Stress-tested: a type of financial analysis used to determine how an institution would fare under adverse economic conditions.